How much can i borrow shared ownership mortgage

Rent is paid on the un-owned share of the property. Buying part of a property through shared ownership is one way of getting a foot on that first rung of the ladder a ladder thats become harder to climb as property prices continue to soar.

Home Ownership And The Uk Mortgage Market An International Review Institute For Global Change

The calculated percentage can also be applied to other shared expenses such as family health insurance.

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

. Shared ownership what were referring to on this website The same as Help to Buy. Changes to shared ownership schemes. Creditors can go after the shared money in the account to satisfy.

Like any form of investment theres a lot to consider before you make the jump as. Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out. This guide sets out how the scheme works in England who can take part and.

Housing Authority co-own a share of the property with you lowering your loan amount. The amount of your deposit and how much you can set aside for monthly mortgage payments. You can borrow the remaining 55 from a commercial mortgage lender.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Please get in touch over the phone or visit us in branch. No lenders mortgage insurance.

Calculate your monthly mortgage repayments to see what you could afford to borrow when moving house remortgaging or buying your first home. Its different to a residential mortgage as instead of buying the whole property you buy a share. You pay rent on the rest.

How much can I borrow. It takes about five to ten minutes. 6704 Total charge for credit.

Our mortgage eligibility guide covers what mortgage lenders look for when deciding how much you can borrow. With an interest only mortgage you only pay the interest each month. You can apply if youre a first-time buyer a previous homeowner who can no longer afford a mainstream mortgage or already live in a shared ownership home and want to move.

A Retirement Interest Only Mortgage is available to people over 55 and is a loan secured against the value of your home. With our Retirement Interest Only Mortgage calculator you can find out how much you could be eligible to borrow in just a few minutes. For more information see the Shared Ownership Wales website.

If youre applying for a mortgage jointly with someone else lenders will use your combined incomes to determine how much you can borrow which usually works out to much more than either applicant could afford on their own. Yet while the concept of shared ownership is straightforward in practice it can be both complicated and expensive. You only pay a mortgage and deposit on the share you own.

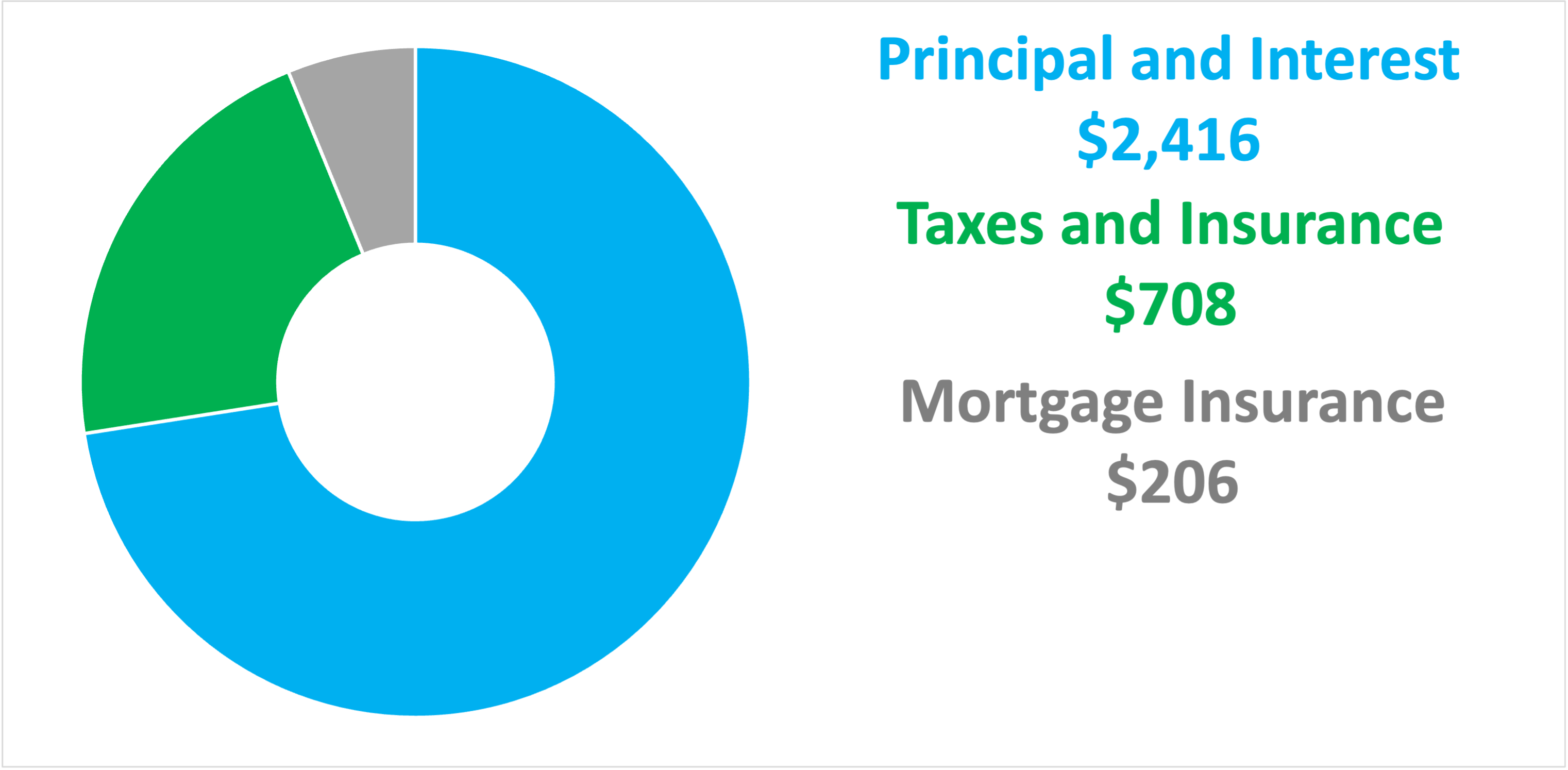

How much you need to pay. As of December 2020 the average home price in the UK was 251500. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage.

Youll pay a mortgage on your share then pay rent on the rest. 801010 loans consist of a first mortgage 80 and a second mortgage 10 that total 90 of the purchase price and a 10 down payment. Shared ownership is a type of mortgage.

Joint ownership also increases the amount of FDIC insurance coverage. Your loved ones would receive a lump-sum payment if you died and depending on your cover could receive a lump sum if you were diagnosed with a critical illness. You can use your first home owner grant FHOG towards your deposit if you build.

As of April 2021 changes to shared ownership schemes were introduced under the governments Affordable Homes Programme including. Thats where shared ownership mortgages can help. Shared Ownership Wales allows 25 to 75 of a housing association home to be bought by those unable to obtain the level of mortgage needed to buy a home outright.

What is a Buy to Let mortgage. How much you can save a month. Gifts or loans from relatives and programs like an 801010 combination loan can help you avoid PMI.

Choose a shared ownership home loan designed to help you get into a home of your own sooner. Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments. Your loan to value is 6000 Interest only.

AA Members 1000 - 2999. A Buy to Let property sometimes referred to as buy to rent or BTL is a type of property investment in which the investor becomes a landlord and rents out the property for profit. Shared ownership is only available to first-time buyers those whove previously owned a home but cant afford to buy one now and existing shared ownership homeowners who want to move house.

Affordability calculator get a more accurate estimate of how much you could borrow from us. Of course this depends on both parties circumstances and the addition of an applicant with very little or no income. If youre a first time buyer saving a big deposit can be tricky.

Lenders mortgage insurance LMI can be expensive. If you bought a 600000 house with a 5 deposit of 30000 then your LMI premium could cost over 22000 based on Finders LMI estimator. These covers are designed to offer some financial protection against the unexpected.

41344 3000 - 4999. The loan is secured on the borrowers property through a process. How much can you borrow.

Shared Ownership just with a non-branded name. Offset calculator see how much you could save. London Help to Buy loans are available on new-build properties worth up to.

Deposit from as low as 2. Use our mortgage calculator to see how much mortgage you can get in the UK how much mortgage you can afford and how much deposit you need for a mortgage. How much do houses cost.

Todays mortgage rates. Your household income must be less than 80000 if you live outside London or 90000 if youre living in London. You must repay the amount you borrowed at the end of the mortgage.

All the news you need. You buy a share usually 25-75. A Buy to Let mortgage is a loan secured against one of these properties.

Before you can apply for a shared ownership mortgage youll need to contact your local housing association to find out if the scheme is available in your area and if youre eligible to apply. See the average mortgage loan to income LTI ratio for UK borrowers. And it doesnt matter if youre single or a couple your household income must be less than 80000 a year 90000 if you live in London.

All the news you need. The taxpayer is required to provide copies of mortgage or rent payments utility bills and maintenance costs to verify the necessary amount. Under the shared ownership program you can purchase a share of your home and pay rent on the remaining mortgage balance until it.

Will be allowed the calculated percentage amount or the standard amount whichever is less. Shared Ownership Wales. You could consider taking out life or life and critical illness insurance alongside your mortgage.

You buy a share usually 25-75.

Kentucky Rural Housing Development Mortgage Guide For 2021 Usda Loans Kentucky Usda Mortgage Lender For Rural Housing Loa Usda Loan Mortgage Loans Home Loans

Dont Miss Out On This Little Known Gem Known As Hud Reo Program Reo Properties Marketing Trends Foreclosures

Key Terms To Know In The Homebuying Process Infographic Real Estate With Keeping Current Matters Home Buying Process Home Buying Real Estate Terms

Mortgage Affordability Calculator Trulia

First Time Buyer Mortgage Advice In 2022 Buying Your First Home Mortgage Advice Home Decor

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

/mortgagemarvel/Asset_based_Home_Loan_Unconventional_Lending_Blog_nonqm_florida_Tampa_Orlando_Miami_Fort_Lauderdale-g5b2f.jpg)

Asset Based Mortgage Everything You Must Know

How Much House Can I Afford Calculator Money

Pin On Housing Market

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Aladdin Homes Built In A Day Catalog No 29 1917 Aladdin Company Free Download Borrow And Streaming Internet Archive Building A House Internet Archive Aladdin

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

450k Mortgage Mortgage On 450k Bundle

My Dad Passed Away And I Ve Been Paying His Mortgage How Can I Get The Loan Put In My Name Fox Business

Cristina Ferrara On Instagram Mortgage Interest Rates Have Dropped Considerably Over The Past Year Locking A Mortgage Interest Rates Interest Rates Mortgage

Can I Get A Shared Ownership Mortgage With Bad Credit Haysto

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference