Stock cost basis calculator

If you sell the stock at the end of one year for 1600 or 16 per share you have a taxable capital gain of 600. The stock average calculator helps to do all the calculations easily and fast.

Pin On Income Tax

So say you buy 100 shares of stock in XYZ company on March 1 again July 1 and once more on October 1 of the same year.

. Just follow the 5 easy steps below. Take the original investment amount 10000 and divide it by the new number of shares you hold 2000 shares to arrive at the new per-share cost basis 100002000 5. The Stock Calculator is very simple to use.

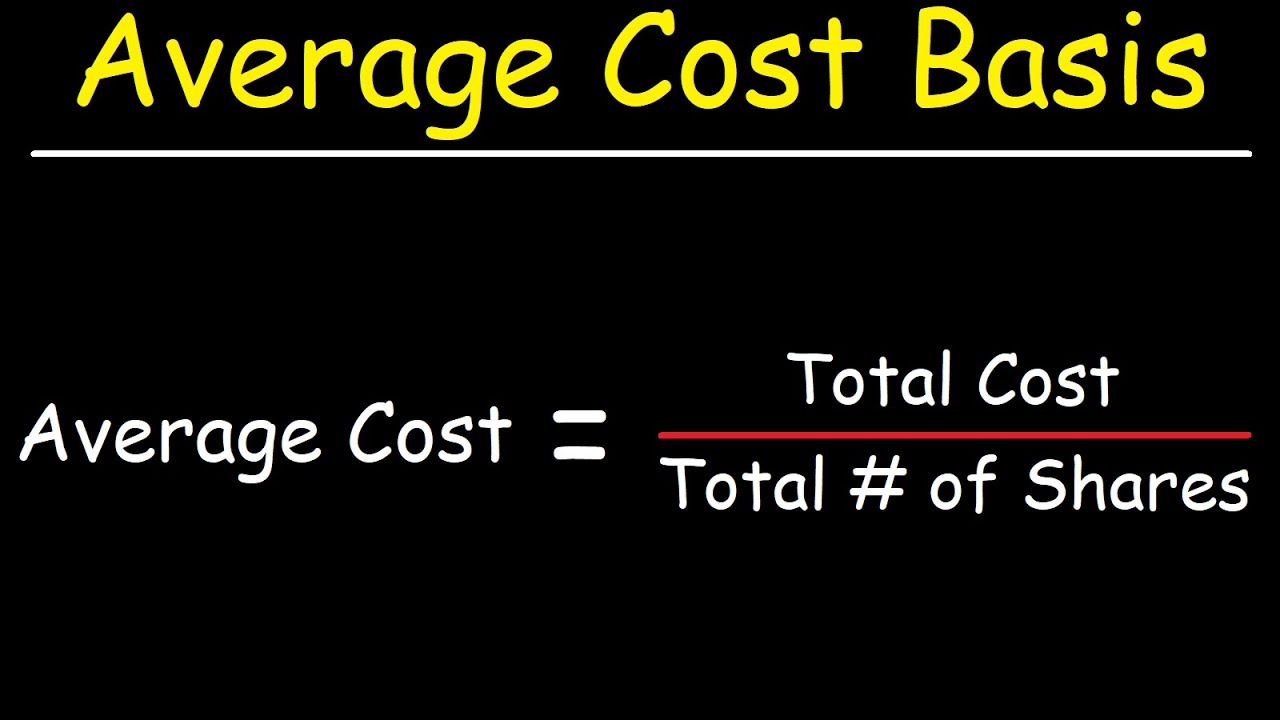

Please note that the form below is just a very simple tool for quick cost basis calculating. With the average cost technique sum up the purchase prices of the shares 12 divide it by three and then you will get 4. The information provided by this cost basis calculator does not purport to be complete or.

By entering the number of shares units and share price cost per unit you can find the total. By Keith Noonan Updated Jun 30 2022 at 1158AM. The information about share purchases is needed to calculate the average cost of the stock.

If the stock paid a. This International Paper Company cost basis calculator is intended for informational purposes only. To calculate your profits for tax purposes youll need to subtract your cost basis for the five shares from the sale price of the five shares.

Select the first letter or number of the stock name you want to look up. This value is used. The cost basis or purchasing price is 1000.

Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the. Knowing how to calculate the cost basis on the inherited stock could save you thousands. 150 x 5 - 100 x 5 250 The 250.

FIFO technique The IRS. Lets use the Ford example from earlier. Cost basis is the original value of an asset for tax purposes usually the purchase price adjusted for stock splits dividends and return of capital distributions.

This is the Cost Basis Calculator as it appears in Excel. Stock Split Calculator for cost basis of cash received in lieu of fractional shares as a result of a stock split. With this stock cost basis calculator you can determine the total cost basis of your investment.

The cost basis is then 4. Instructions on use are also included. You pay 100 per share in March 125 per share in.

CALCULATOR FOR STOCK SPINOFFS Press the CTRL key simultaneously with the F5 key to refresh the calculator and make sure you are using the latest version before you enter any data. View and compare COSTbasiscalculator on Yahoo Finance. Stock Merger Calculator Stock Split Calculator SPDR Gold Shares Calculator stock.

This calculator purely serves to help you determine your adjusted original cost basis per share for the major events affecting your stock using the dollar amount you entered as your unadjusted. You calculate the cost basis for a stock youve purchased by taking the cost of the shares plus the commission your broker charges.

Etf Vs Index Funds Top 8 Differences You Must Know Stock Exchange Index Fund

7h7t3irp8kdqtm

Stock Cost Basis Spreadsheet Spreadsheets Provided Us The Prospective To Input Change And E Planilhas

Guide To Calculating Cost Basis Novel Investor

Irr Vs Roi Infographics Here Are The Top 4 Difference Between Roi And Irr Personal Finance Infographic Investing

Average Cost Calculator Crypto Stocks Forex Trading

How To Calculate Your Average Cost Basis When Investing In Stocks Youtube

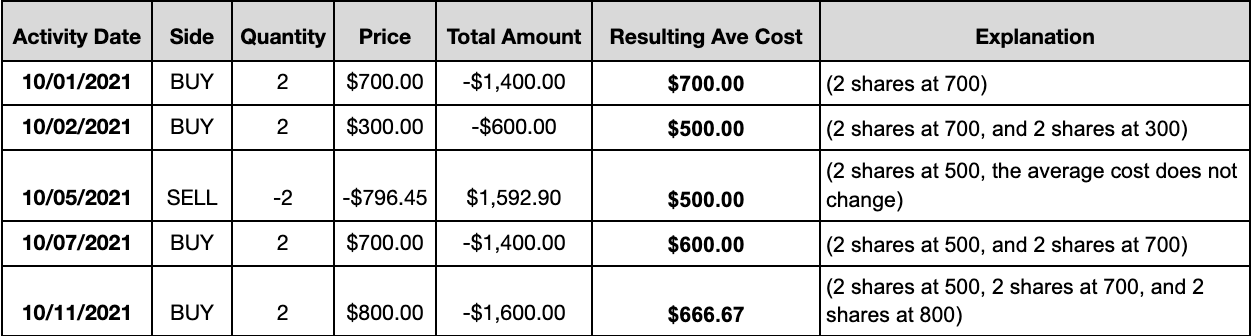

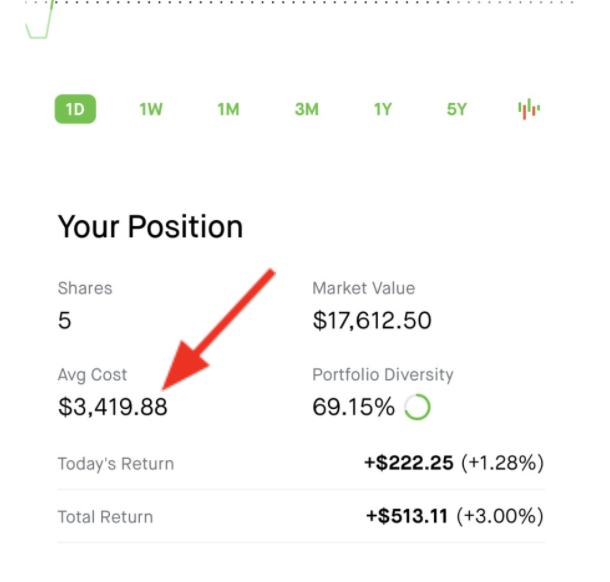

Average Cost Robinhood

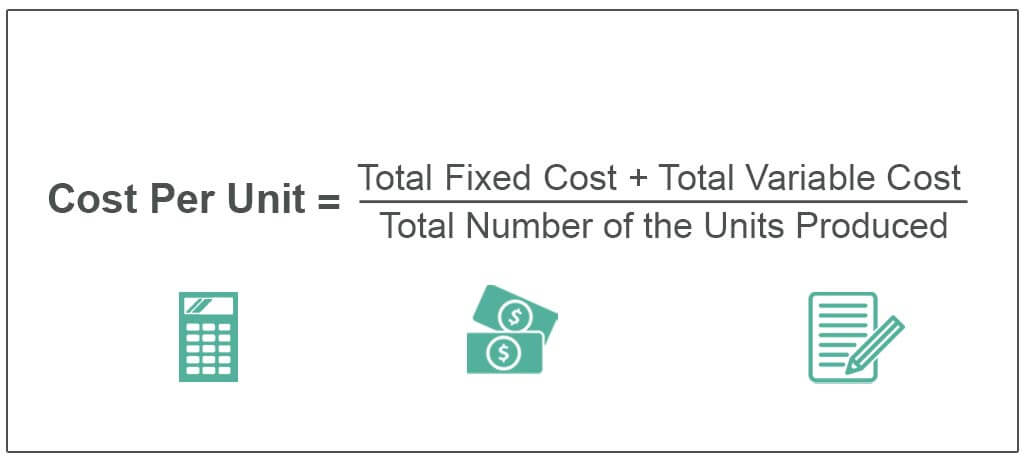

Cost Per Unit Definition Examples How To Calculate

Future Value Of An Ordinary Annuity Mgt680 Lecture In Hindi Urdu 25

Cost Basis Calculator

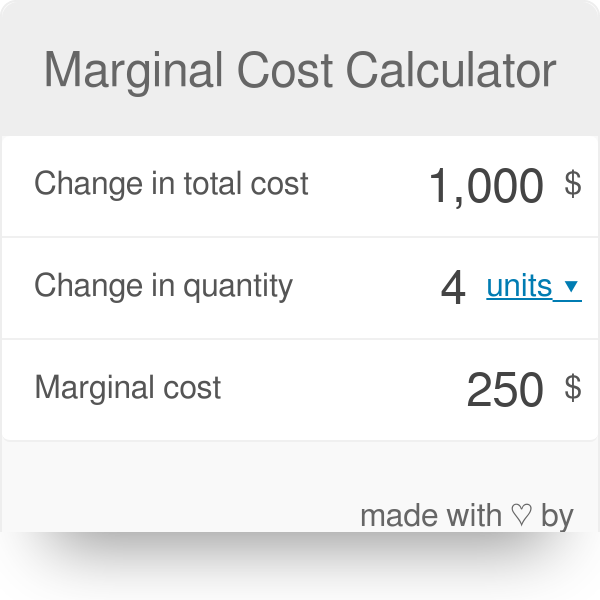

Marginal Cost Calculator

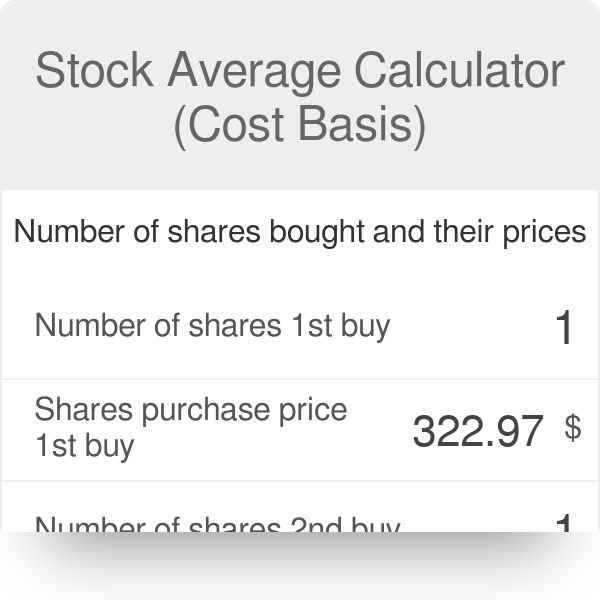

Stock Average Calculator Cost Basis

Average Cost Robinhood

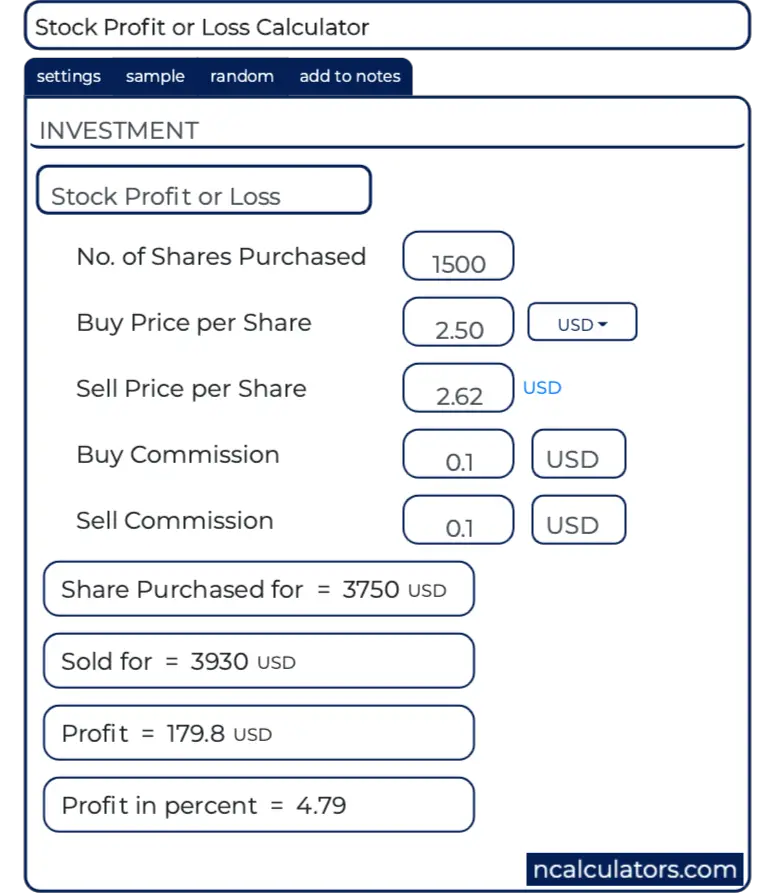

Stock Profit Or Loss Calculator

Stock Average Calculator Cost Basis

How To Calculate Your Average Cost Basis When Investing In Stocks Youtube